Experience Growth with CDs and IRAs

Grow your savings safely with CDs and IRAs, offering guaranteed returns and low starting balances. You choose how long to save while enjoying the freedom to reinvest or adjust your plan as life evolves. It's a secure, flexible way to build for your financial future.

- Guaranteed growth with a fixed APY

- Flexible maturity dates from six months to five years

- Safe and stable investments

- Reinvest your deposits at maturity or ladder multiple certificates of deposit

What is a CD?

A Certificate of Deposit (CD) is a type of savings account that earns interest when kept in the account for a pre-determined length of time. There are penalties to withdraw money from the account before the account has “matured” or reached the end date. However, you can choose the length of time that works best for you, that’s why CDs come in so many different terms! Ready to lock in a great CD rate?

Open a CD Today

Ready to finish or check the status of your application? Click here.

New Members

Don't have online banking yet? Enroll now or visit a branch.

Why Choose an IRA?

An Individual Retirement Account (IRA) is an easy, inexpensive, and low-risk investment option that allows anyone to be able to save for retirement. Enjoy tax-deferred earnings and, in some cases, tax-deductible contributions.*

*Please consult your tax advisor.

Open an IRA Today

In Person

Explore

See All Posts

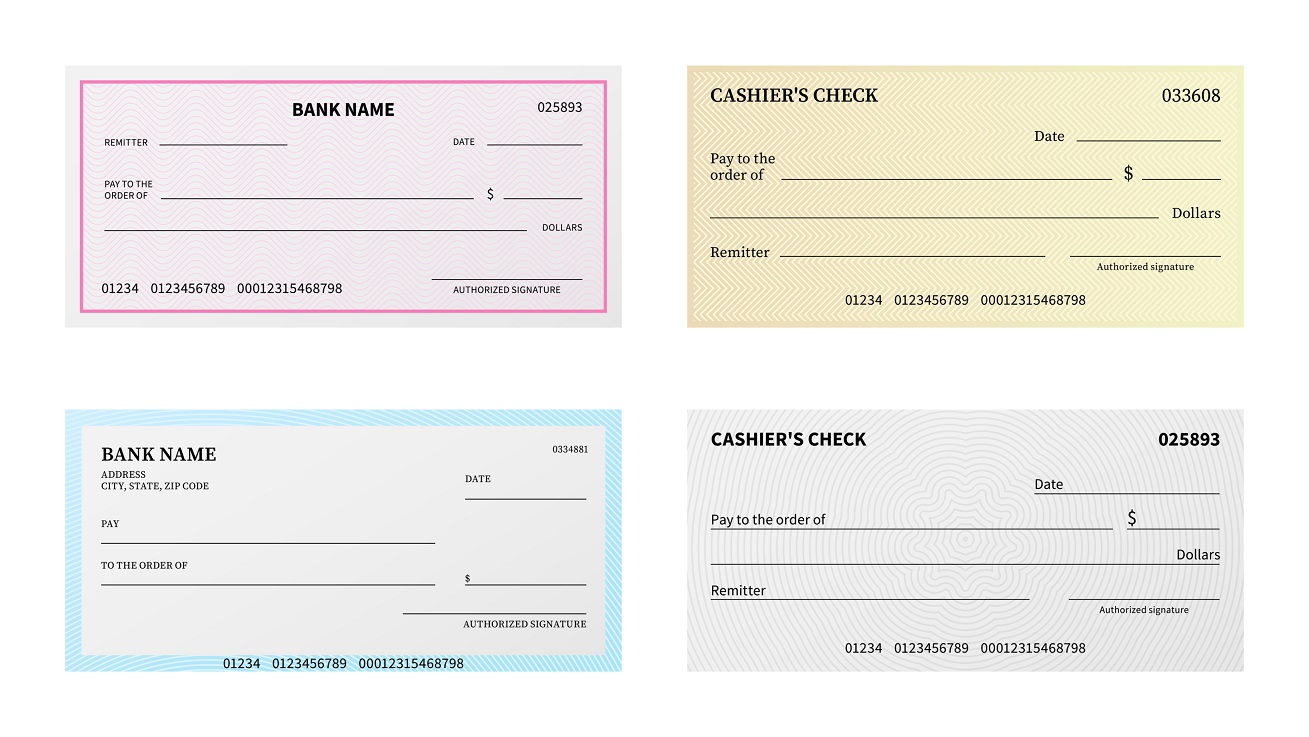

How to Spot Fake Check Scams: Protect Yourself and Your Finances

Team News

Tina M. Brown Joins St. Mary’s Bank as Business Development Team Lead

Team News

Forgot

Forgot