Deposit Scams

There are many variations of the deposit scam, but all involve depositing or accepting what you believe to be legitimate funds and then forwarding a portion of the funds to another individual.

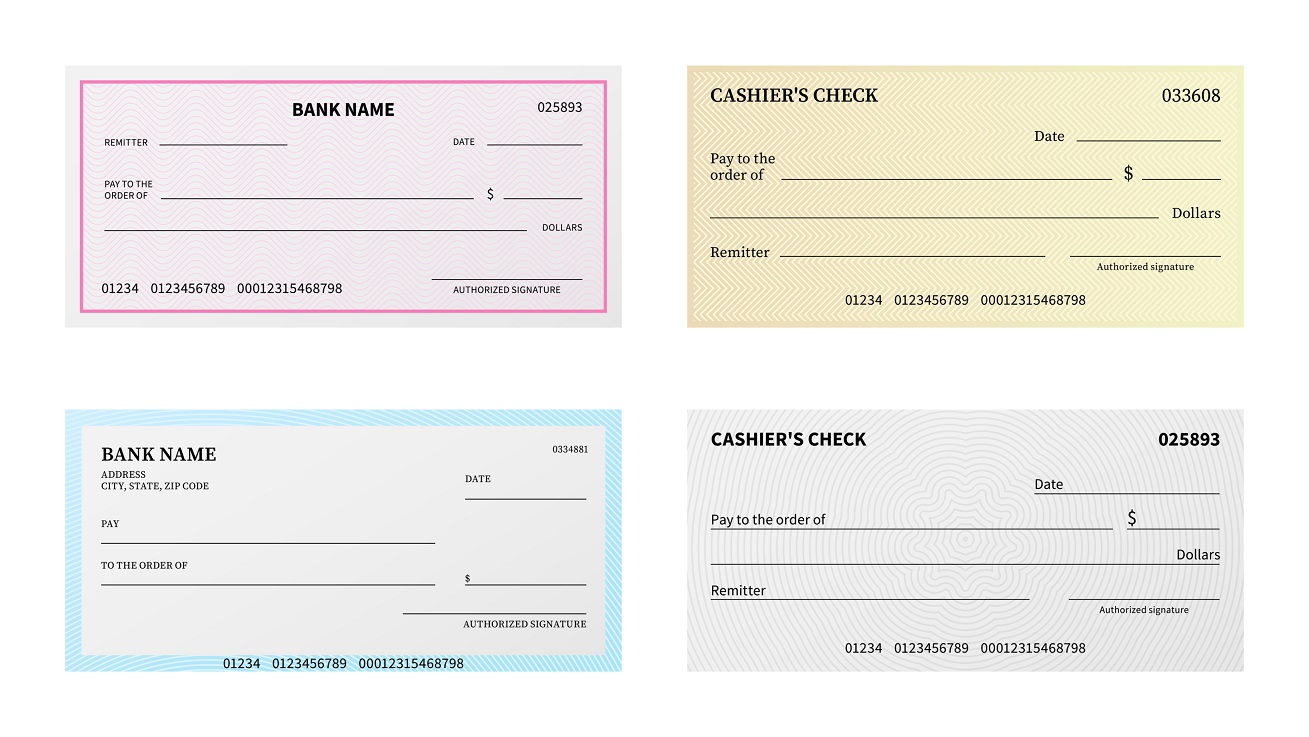

Some of these scams involve checks that appear to be cashier’s checks drawn on real banks, US Postal money orders, or other “guaranteed funds.” In some cases the fraudster convinces you to provide your online banking credentials, which you should never do.

It could take up to 7 business days for checks to clear the paying bank, and you may be responsible for these transactions.

Do Not Fall for These Common Scams

- You get an online job and receive checks by mail OR you are asked to provide online banking credentials to accept payments to your account. Common scam job offers include cashing US checks for companies overseas, working as a mystery shopper, working as an interpreter, doing car wrap advertising, etc.

- You sell something online, but the buyer either mistakenly sends you too much money or they send you extra money to pay their “shipping agent.”

- You have won a foreign lottery and you must pre-pay taxes (this is not how the government collects taxes; it is against federal law to advertise or pay out a non-US lottery through the US mail).

- You have been chatting with someone online for months; they are overseas or need help getting funds, so they or their friend will send you the funds, and you just need to send the funds to someone else, or invest the funds for this friend.

- You are looking for a roommate and someone sends you a check to cover the cost of rent, or for you to purchase items for them. They unexpectedly have an emergency that then prevents them from moving and ask you to return the funds.

PC Repair / Tech Support Scams

You receive a call or an email, or you click a link in an email that states your PC is infected or has a virus, and you’re told to call a telephone number or click another link. You are then told that in order to remove the virus, you either need to pay for more protection or you must allow remote access to your computer to run a test.

Legitimate tech companies will not contact you by phone, text, or email to notify you of a virus or unusual activity as they don’t have access to your PC. Legitimate anti-virus pop-up warnings will never ask you to call a phone number to resolve an issue.

Phishing

Most email scams involve “phishing” in which the e-mail notes an urgent need to either click on a link or visit a website in order to protect accounts, re-establish locked accounts, or to avoid future fraud to accounts. The link or website may look exactly like a legitimate website, but it is a “dummy” site that is set up to collect the private information you provide so the scammer can commit identity theft or to initiate unauthorized transactions. You should never call the number or visit the website provided in the email. Instead, contact the sender directly at a known number or website directly.

In some cases, the link in the email contains malicious code that is installed on your computer without your knowledge. This is especially true if you don’t keep your anti-virus and operating system updated. This malicious code can include scammers who keep track of the websites you visit, including the user IDs and passwords you enter, or it could include code that allows your computer to be taken over as part of a massive attack against a larger victim.

Don't Get Hooked

Do not open emails from unknown senders, and never click on links or attachments in suspicious e-mails. If you need to contact the sender, contact them directly at a known phone number or website.

Hover over the link to validate the website location, or use your Favorites/Bookmarks you’ve saved rather than clicking on links.

Pay close attention to any spelling errors in the links or sender info (e.g., it’s from amazone.com instead of amazon.com.

Forgot

Forgot